- Change theme

Smart Money Moves: How to Enhance Your Lifestyle and Savings

This blog post will take you through smart money moves that can help you live better while building your savings.

21:49 09 August 2024

Life's a rollercoaster, right? One minute you're savoring that perfect cup of coffee, the next you're crunching numbers, wondering how on earth to make ends meet. Let's face it, the whole adulting thing is tough. Especially when it feels like everyone else is effortlessly jet-setting while you're figuring out how to afford groceries.

But guess what? You're not alone. With 60% of Americans living paycheck to paycheck, it's clear many of us need to rethink our approach to money. This blog post will take you through smart money moves that can help you live better while building your savings.

1. Setting Financial Goals

Setting clear financial goals is like plotting a course on a map. It gives you direction and purpose. Studies show that people who set specific financial goals are 42% more likely to achieve them. But how do you set goals that work?

Tips for Effective Goal Setting:

- Be specific: Instead of 'save more,' aim to 'save $5,000 for a vacation by December."

- Make them measurable: Use numbers and dates to track progress

- Keep them realistic: Start small and build up to bigger goals

- Write them down: This simple act can make your goals feel more real

"A goal without a plan is just a wish." - Antoine de Saint-Exupéry

Take 15 minutes today to write down three financial goals - one for the next month, one for the next year, and one for the next five years.

For instance, Boise is not only known for its vibrant arts scene and stunning outdoor activities but also for its practical opportunities to make smart financial decisions. Residents can enhance their lifestyle and savings by exploring local financial options. Car loans in Boise can provide a more budget-friendly way to manage large purchases, like a new vehicle while maintaining financial stability.

In addition to savvy borrowing, Boiseans can benefit from reducing high-interest debt and investing wisely in retirement accounts like IRAs or 401(k)s. By adopting these smart money moves, residents can enjoy a more fulfilling lifestyle while building a financial future.

2. Budgeting for a Better Lifestyle

A budget isn't about restricting yourself; it's about understanding your money flow. With this knowledge, you can make smarter choices about spending and saving.

Budgeting Best Practices:

- Track every expense for a month to see your real spending habits

- Use the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings and debt repayment

- Try using budgeting apps, they can help you save an average of 15% more compared to not using them.

Review your budget weekly at first, then monthly as you get more comfortable with your spending plan.

3. Smart Investment Strategies

Investing isn't just for the wealthy. It's a key strategy for building long-term wealth and achieving financial freedom.

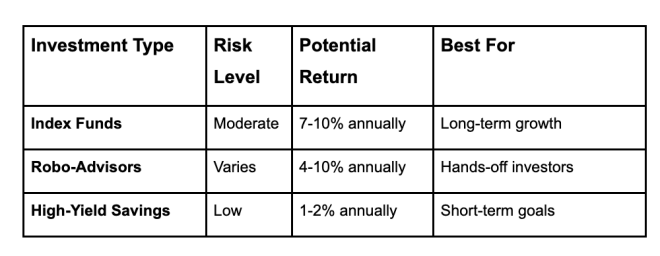

Investment Options for Beginners:

- Index funds: Low-cost way to invest in a broad market

- Robo-advisors: Automated investing based on your goals and risk tolerance

- High-yield savings accounts: For short-term goals and emergency funds

Did you know that a diversified investment portfolio can reduce volatility by up to 30% compared to investing in a single asset class?

Comparison: Investment Options

If you're new to investing, start by putting just 1% of your income into a low-cost index fund. Increase this percentage as you get more comfortable.

4. Reducing Debt Strategically

Debt can be a major roadblock to financial freedom. Tackling it strategically can save you thousands and reduce stress.

Debt Reduction Strategies:

- Snowball Method: Pay off the smallest debts first for quick wins

- Avalanche Method: Focus on highest-interest debts to save more long-term

- Debt Consolidation: Combine multiple debts into one lower-interest payment

The Power of Prioritizing High-Interest Debt: Paying off a $5,000 credit card balance at 20% interest within a year can save you over $1,000 in interest charges. Always pay more than the minimum on your debts. Even an extra $50 a month can significantly reduce your repayment time.

5. Creating Additional Income Streams

In today's gig economy, creating multiple income streams is easier than ever. Nearly 44% of Americans engage in side hustles, earning an average of $1,122 per month.

Popular Side Hustle Ideas:

- Freelance writing or graphic design

- Driving for ride-share services

- Selling handmade items online

- Tutoring or online teaching

- Renting out a spare room

Benefits of multiple income streams include:

- Increased financial security

- Faster debt repayment

- More money for savings and investments

- Opportunity to explore new interests

Brainstorm three potential side hustles based on your skills and interests. Research the market demand for each and choose one to start this month.

6. Planning for Major Expenses

Life's big moments often come with big price tags. Planning can help you enjoy these milestones without financial stress.

Savings Strategies for Major Expenses:

- Open a dedicated high-yield savings account for each goal

- Automate transfers to your savings accounts

- Cut unnecessary expenses and redirect the savings

- Consider short-term investments for medium-term goals (2-5 years out)

Financial experts recommend setting aside 20% of each paycheck for significant upcoming life events.

Sample Savings Plan for a $20,000 Wedding in 2 Years:

- Monthly savings needed: $833

- Cut daily coffee shop visits: Save $100/month

- Reduce dining out: Save $200/month

- Side hustle income: $400/month

- Remaining from regular savings: $133/month

Use a savings calculator to determine how much you need to save monthly to reach your goal.

7. Regular Financial Reviews

Your financial situation isn't static, so your plans shouldn't be either. Regular reviews help you stay aligned with your goals and adapt to life changes.

How Often to Review Your Finances:

- Weekly: Check your budget adherence

- Monthly: Review your progress on short-term goals

- Quarterly: Assess your investments and overall financial health

- Annually: Conduct a comprehensive review of all financial aspects

Did you know that people who review their finances quarterly save 25% more than those who don't? What to cover in your financial review:

- Budget performance

- Progress toward savings goals

- Investment performance

- Insurance coverage adequacy

- Credit report check

Set calendar reminders for your weekly, monthly, quarterly, and annual financial reviews.

Frequently Asked Questions

What are the benefits of smart money?

Smart money refers to funds invested or managed by experienced, well-informed individuals or institutions. Its benefits include potentially higher returns due to expert knowledge, better risk management, and access to exclusive investment opportunities. Smart money can also influence market trends and provide valuable insights for other investors.

What is a smart thing to do with money?

A smart thing to do with money is to create a balanced financial plan. This includes building an emergency fund, paying off high-interest debt, investing for long-term goals like retirement, and diversifying your investments across different asset classes. It's also wise to educate yourself about personal finance and consider seeking advice from financial professionals.

How can I be smart for money?

To be smart with money, start by creating a budget to track income and expenses. Invest in your education and skills to increase your earning potential. Make informed decisions about major purchases and avoid impulse spending. Consider automating your savings and investments. Stay informed about financial matters and be willing to adapt your strategy as your circumstances change.